All about Insurance Agent In Jefferson Ga

Wiki Article

See This Report about Insurance Agent In Jefferson Ga

Table of ContentsThe smart Trick of Insurance Agent In Jefferson Ga That Nobody is Talking AboutSome Ideas on Auto Insurance Agent In Jefferson Ga You Should KnowThe 5-Minute Rule for Business Insurance Agent In Jefferson GaSome Known Facts About Home Insurance Agent In Jefferson Ga.

Discover more concerning how the State of Minnesota sustains active duty participants, veterans, and their family members.

Term insurance policy supplies security for a given period of time. This duration can be as brief as one year or supply insurance coverage for a details variety of years such as 5, 10, twenty years or to a defined age such as 80 or in some situations up to the earliest age in the life insurance mortality.

The longer the warranty, the higher the preliminary premium. If you pass away throughout the term duration, the business will certainly pay the face amount of the plan to your recipient. If you live beyond the term period you had picked, no benefit is payable. Generally, term plans provide a fatality advantage without savings component or money worth.

Business Insurance Agent In Jefferson Ga Can Be Fun For Anyone

The premiums you pay for term insurance policy are reduced at the earlier ages as compared to the premiums you spend for long-term insurance policy, but term prices increase as you expand older. Term plans might be "exchangeable" to an irreversible plan of insurance coverage. The protection can be "level" offering the very same benefit up until the policy runs out or you can have "lowering" protection during the term period with the premiums remaining the exact same.Presently term insurance coverage rates are extremely competitive and amongst the most affordable traditionally skilled. It must be kept in mind that it is a widely held belief that term insurance is the least expensive pure life insurance policy protection readily available. http://known.schwenzel.de/2015/fachblog-fr-irrelevanz. One requires to review the policy terms carefully to decide which term life alternatives appropriate to satisfy your specific scenarios

The length of the conversion period will vary depending on the type of term plan bought. The costs price you pay on conversion is normally based on your "current attained age", which is your age on the conversion date.

Under a level term policy the face amount of the plan continues to be the exact same for the whole period. Usually such policies are marketed as home loan security with the quantity of insurance policy reducing as the balance of the mortgage lowers.

Indicators on Insurance Agent In Jefferson Ga You Need To Know

Traditionally, insurance providers have not had the right to alter costs after the policy is marketed. Since such plans might proceed for several years, insurance providers should make use of traditional death, rate of interest and expense rate quotes in the costs estimation. Adjustable costs insurance, however, allows insurance providers to offer insurance policy at reduced "present" premiums based upon less conventional assumptions with the right to change these costs in the future.

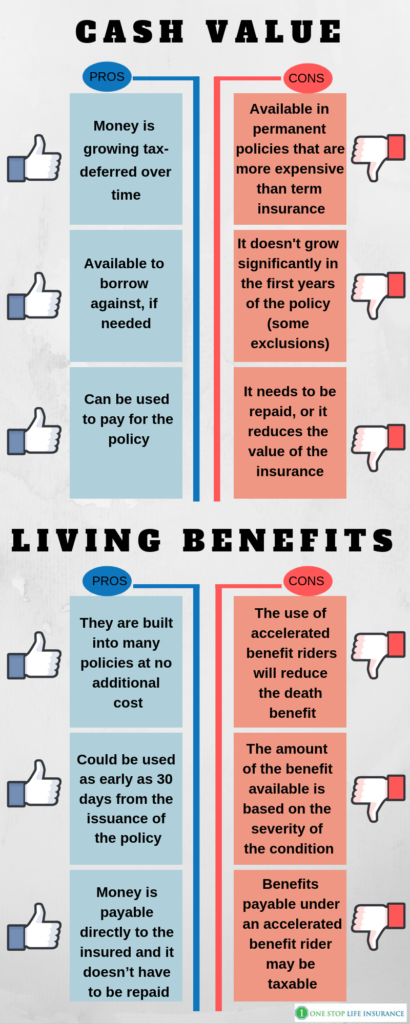

Sometimes, there is no correlation between the size of the cash worth and the costs paid. It is the money value of the policy that can be accessed while the insurance holder is alive. The Commissioners 1980 Requirement Ordinary Mortality Table (CSO) is the present table utilized in determining minimum nonforfeiture values and plan gets for regular life insurance policy plans.

The plan's crucial components contain the costs payable annually, the death advantages payable to the recipient and the cash abandonment value the insurance policy holder would certainly get if the policy is given up before death. You might make a loan against the cash money worth of the policy at a defined price of rate of interest or a variable interest rate but such outstanding car loans, if not settled, will certainly decrease the survivor benefit.

The Buzz on Business Insurance Agent In Jefferson Ga

If these price quotes transform in later years, the company will adjust the premium appropriately but never ever over the maximum assured premium stated in the plan. An economatic entire life plan offers a fundamental amount of getting involved whole life insurance policy with an extra supplemental coverage supplied via using returns.

Ultimately, the reward additions need to equate to the original amount of supplementary protection. However, due to the fact that returns might not suffice to purchase enough paid up additions at a future day, it is possible that at some future time there might be a substantial decrease in the quantity of supplemental insurance protection.

Since the premiums are paid over a shorter span of time, the costs repayments will be higher than under the entire life strategy. Single costs whole life is check my blog minimal repayment life where one big superior payment is made. The policy is completely paid up and no more costs are needed.

Report this wiki page